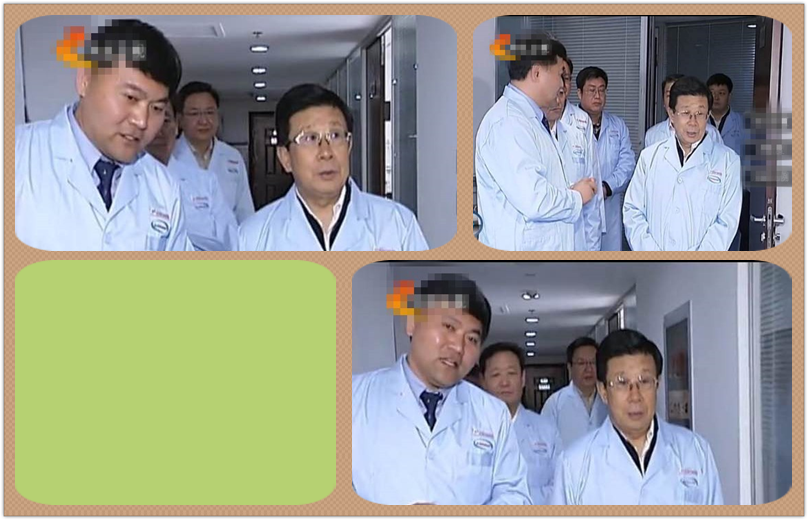

Hebei provincial party committee secretary Zhao Kezhi visited Rainbow Laboratories

2016-04-22 16:54:30 On 11th April, Hebei Provincial Party Committee Secretary Zhao Kezhi accompanied by Shijiazhuang Municipal Party Committee Secretary Sun Ruibin and Shijiazhuang Vice Mayor Jiang Wenhong came to our lab for inspection. Our Managing Director Mr. Wang Yong welcomed the group and introduced in detail the working condition of the lab regarding the third-party testing, international regulatory registration and internationalization and industrialization of R&D. Meanwhile, Mr. Wang reported the project status of our new animal health preparations plant which is located in Shijiazhuang Economic and Technological Development Zone. Mr. Zhao fully affirmed the work we have done, highly appreciated our effort on setting up the international standard of medical products, and expressed the hope that we could make greater contribution to the internationalization of Hebei pharmaceutical industry and industrialization of science and technology projects.

On 11th April, Hebei Provincial Party Committee Secretary Zhao Kezhi accompanied by Shijiazhuang Municipal Party Committee Secretary Sun Ruibin and Shijiazhuang Vice Mayor Jiang Wenhong came to our lab for inspection. Our Managing Director Mr. Wang Yong welcomed the group and introduced in detail the working condition of the lab regarding the third-party testing, international regulatory registration and internationalization and industrialization of R&D. Meanwhile, Mr. Wang reported the project status of our new animal health preparations plant which is located in Shijiazhuang Economic and Technological Development Zone. Mr. Zhao fully affirmed the work we have done, highly appreciated our effort on setting up the international standard of medical products, and expressed the hope that we could make greater contribution to the internationalization of Hebei pharmaceutical industry and industrialization of science and technology projects.

Until now, Shijiazhuang Rainbowlabs Pharmaceutical Technology Co., Ltd (hereinafter referred to as “Rainbow Laboratories”) has been approved and qualified by the US FDA, Health Canada and CNAS China, which is the first one in China that obtained a combination of above three high-end international standard qualifications with rigorous quality system, safe and reliable testing results. Meanwhile, Rainbow Laboratories has successfully guided many pharmaceutical companies to pass the U.S. FDA inspections with their international regulatory registration ability and advanced concept, thus helped their products to be exported to European and American markets.

Shijiazhuang Rainbowlabs pharmaceutical Technology Co. Ltd Copyright

Go Top

Go Top

comments list

I want to comment