Congratulations to Rainbowlabs for passing the CNAS inspecti

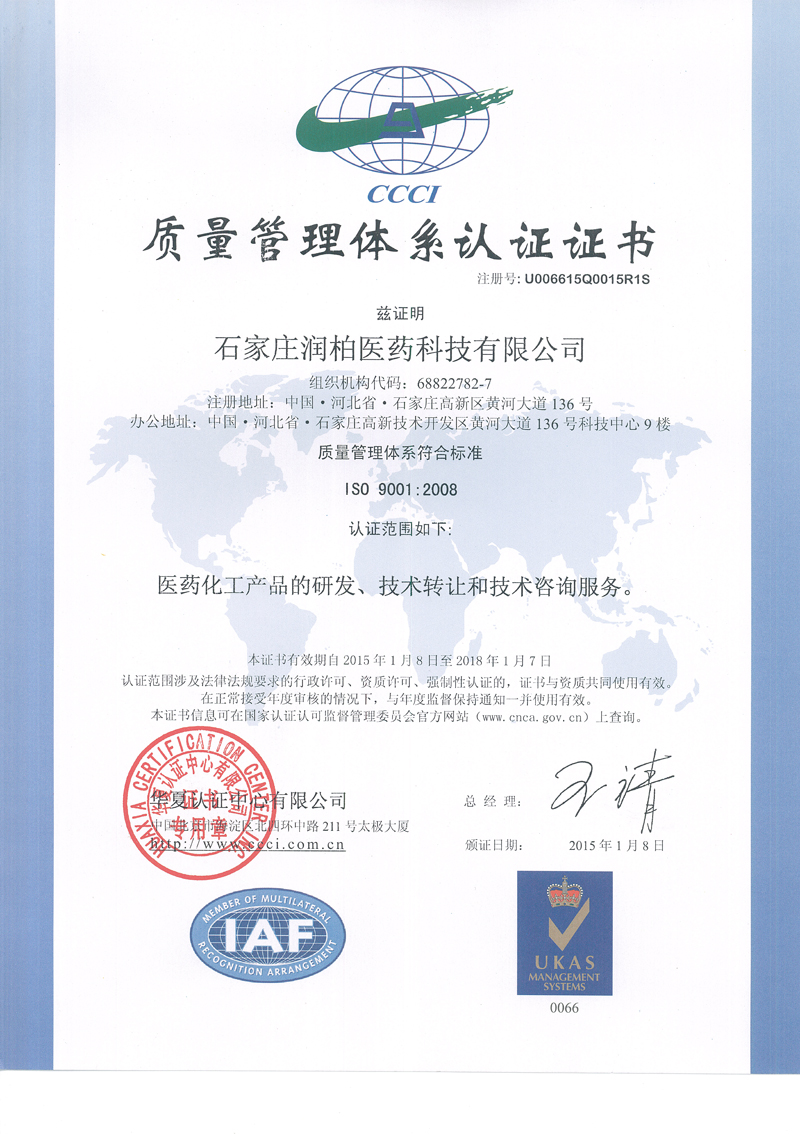

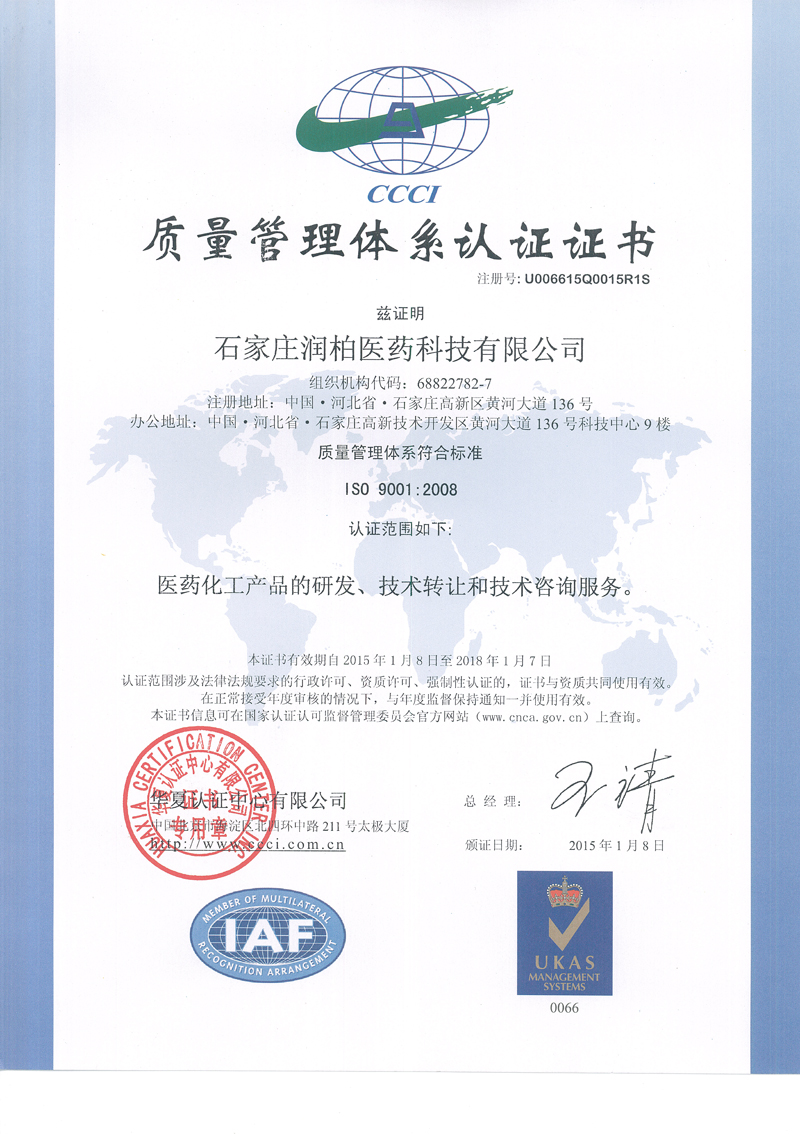

2015-06-16 15:26:42 A good news came that Rainbow Labs passed the site assessment of China National Accreditation Service for Conformity Assessment (CNAS) on November 9, 2014. At present, CNAS is the unique and most authoritative laboratory accreditation certification body. Being approved by CNAS, proves that our level and capacity are up to international standard, product inspection result reliable. The certificate or report issued by us, will be recognized by 56 countries in a mutual recognition system.

A good news came that Rainbow Labs passed the site assessment of China National Accreditation Service for Conformity Assessment (CNAS) on November 9, 2014. At present, CNAS is the unique and most authoritative laboratory accreditation certification body. Being approved by CNAS, proves that our level and capacity are up to international standard, product inspection result reliable. The certificate or report issued by us, will be recognized by 56 countries in a mutual recognition system.

Since then, Rainbow Labs becomes a laboratory which is approved and qualified by the US FDA, Health Canada and CNAS China at the same time. We will constantly make intensified effort on international registration and mutual recognition, unswervingly adhere to the strategy of quality innovation combined with the international high-end market access.

Shijiazhuang Rainbowlabs pharmaceutical Technology Co. Ltd Copyright

Go Top

Go Top

comments list

I want to comment